Clean Yield Insights

Q2 2023 Market Update: Take What the Market Gives You

There are lots of cycles for an investor to consider: economic, credit, profit, interest rate, and stock market. Where we are in a cycle has crucial investment consequences. The decade up to the COVID pandemic was a prolonged cycle of…

Q1 2023 Market Update: Rough Seas Ahead

The federal government seems to have stemmed the recent banking crisis for now. Its aggressive intervention to back customer deposits has had the intended calming effect. The Federal Reserve, however, was partly responsible for the collapse of Silicon Valley Bank,…

Q4 2022 Market Update: Turning the Page

2022 in Review

Ouch! It was the worst year for global stock markets since the 2007-2009 global financial crisis. We’re not surprised. After the rampant speculation of 2021 in cryptocurrencies, “meme stocks,” and “disruptive innovator” companies, 2021 ended with stock…

Clean Yield Celebrates Cooperative Month

October is Cooperative Month! In honor of Cooperative Month, we want to share a bit about what co-ops are and why Clean Yield loves them.

What is a co-op?

A co-op is a group or organization that is owned and…

Q3 2022 Market Update: Rear View

No, we are not referring to the 1954 thriller directed by Alfred Hitchcock. We are referring to what Fed Chairman Powell seems to be looking through in driving monetary policy. Rear-view driving ends badly; when the Fed does it, the…

Q2 2022 Market Update: “Are We There Yet?”

The first half of year was the worst for the S&P 500 stock index since 1970, as it fell by nearly 21%. The technology-heavy NASDAQ index fell by 30%, a record. Many of the most speculative favorites of the prior…

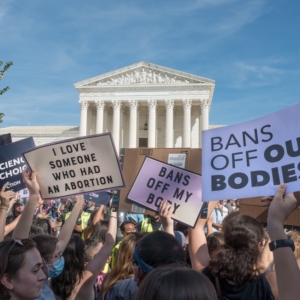

Post-Roe: Anger and Action

We’re angry and we’re scared. Angry that vital rights have been taken away from women. Angry that a small group of people with so much power can simply overturn “settled law” in a way that’s in conflict with the wants…

Q1 2022 Market Update: A Fragile Market Meets War and Inflation

War in Ukraine’s Impact on Investment Markets

Does the upending of the post-World War II geopolitical order alter our investment strategy? Yes, but not how you might think. We’re still extraordinarily negative toward global stock markets but much more enthusiastic…

Stock Market “Corrections” and “Bear Markets”

The stock market (as measured by the S&P 500 index) is down sharply since the start of the year. We thought we would use this moment to clarify some of the terminology and nuances of market downturns.

Amid a long…

Q4 2021 Market Update: Herd Immunity?

We can sum up 2021 quite simply: Covid, Covid, Covid … and the S&P 500 stock market index hit a record high (more than 70 times). But let’s look “under the hood” and assess prospects for 2022.

This year might…

Night School December 2021: Inflation

Inflation is in the news every day. We see it first-hand at the gas station, the grocery store, and elsewhere. It clearly has captured the attention of both the public and investors. The number of Google searches for “stagflation” (a…

Q3 2021 Market Update: Market Anatomy and Today’s Diagnosis

Many stock market observers focus on “fundamentals.” They eagerly scrutinize the latest economic report or company earnings results. Market participants quickly (over)react to the latest news. Yes, the economy and corporate profits are important to future returns, but investor psychology…