A New Kind of Meat

By Elizabeth R. Levy, CFA

In late 2025, as a result of our membership in the U.S. Sustainable Investment Forum (US SIF), I was invited to attend a meeting for company founders and investors organized by the Association for Meat, Poultry and Seafood Innovation at the Center for Cellular Agriculture at Tufts University outside of Boston. I don’t think I have ever responded “yes” to an invitation so quickly, and the afternoon of fascinating conversations lived up to my expectations about the developing industry euphemistically called cultured or cultivated protein.

I was excited to learn about what might be the next innovation in trying to feed the planet’s meat eaters more sustainably and how companies are approaching bringing this innovation to consumers globally—and potentially someday to portfolios. This conversation became even more important in January, as the new inverted food pyramid encourages Americans to eat even more meat and protein than we already are. Given the enormous climate, local environment, and social implications of traditional meat production in large, industrial, centralized facilities, finding new ways to satisfy the demand for meat while minimizing the negative impacts it brings is even more important.

What Is Cultivated Meat?

The Good Food Institute, a nonprofit food systems think tank, identifies three types of alternative proteins:

- Plant-based, such as Beyond and Impossible, using plant proteins to mimic animal ones

- Fermentation, using microorganisms to grow ingredients for alternative proteins, such as Quorn

- Cultivated meat, growing meat directly from cells

This meeting focused on the third option, cultivated or cultured meat. These products are grown from animal cells in food production facilities, using bioreactors similar to those used in making beer or cheese, and approved by the USDA or FDA, resulting in a substance that is identical to conventional meat at the cellular level, made of animal fats and proteins.

Some of the companies present at the event (without commenting on the financial viability of any of them) included salmon producer Wildytpe; Australian Vow; and bacon, meatball, and pepperoni company Mission Barns.

Stay up the date with the impact investing landscape with our newsletter.

We integrate a company’s environmental, social, and governance (ESG) profile into our analysis of its financial prospects and stock valuation. We are always looking for ways to maximize the positive impact our clients’ assets can make in the world, whether through proxy voting, shareholder activism, or impact investing.

Why Is the Cultivated Meat Industry Interesting to Clean Yield?

As indicated above, a host of negative social and environmental impacts stem from conventional, industrialized meat production. And yet, the United Nations (UN) projects that global demand for animal-based products will increase by 6% per capita by 2034. While more localized and regenerative agriculture and animal husbandry can and do mitigate these externalities, the scope of the growing demand will call for other solutions as well. Cultured meat could be well-suited to help address some of these impacts, including:

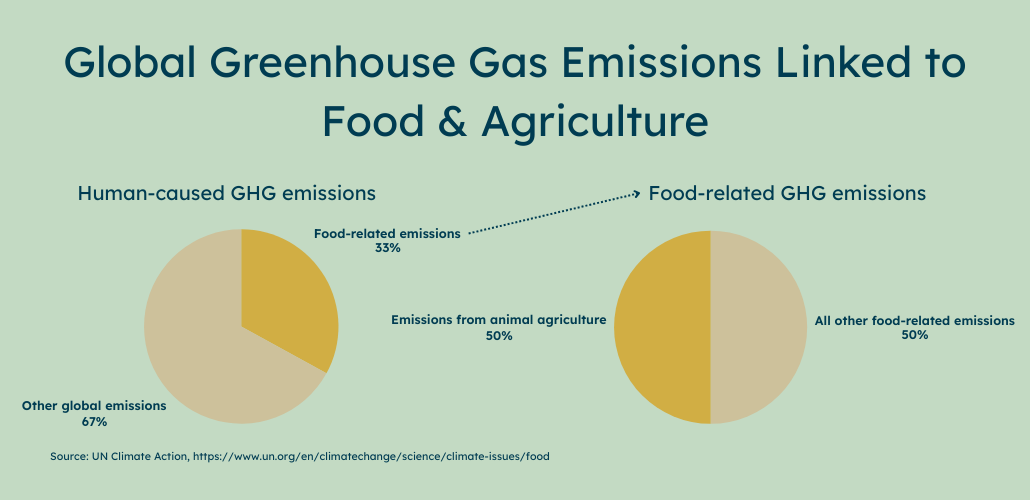

- Climate change and sustainability: Researchers estimate that about a third of greenhouse gas emissions are linked to food, including land and fertilizer use. Over half of global greenhouse emissions from food production are attributed to animal agriculture. One driver for interest in this industry is reducing the carbon footprint of meat eating, in addition to avoiding ethical issues of raising animals intended for slaughter. A representative of a cultured seafood company at the meeting made a very compelling argument that as the oceans continue to warm and as many fish stocks are already at unsustainable levels, cultivated seafood may be the only option to continue consuming seafood in the future.

- Impact to local communities: In addition to climate impacts, conventional animal agriculture also results in well-documented local environmental impacts, ranging from water and fertilizer use to grow feed to animal-waste contamination of water. These impacts are mitigated by having the meat grown in a lab rather than on an industrial farm.

- Labor safety: According to 2023 data from the Occupational Safety and Health Administration, jobs in the animal production, animal slaughtering, and seafood preparation industries had an injury and illness rate considerably higher than the national average; hog and pig farming in particular has a rate more than 3 times the national average. The incident rate for biological product manufacturing, which cultured meat resembles, is far lower than the national average.

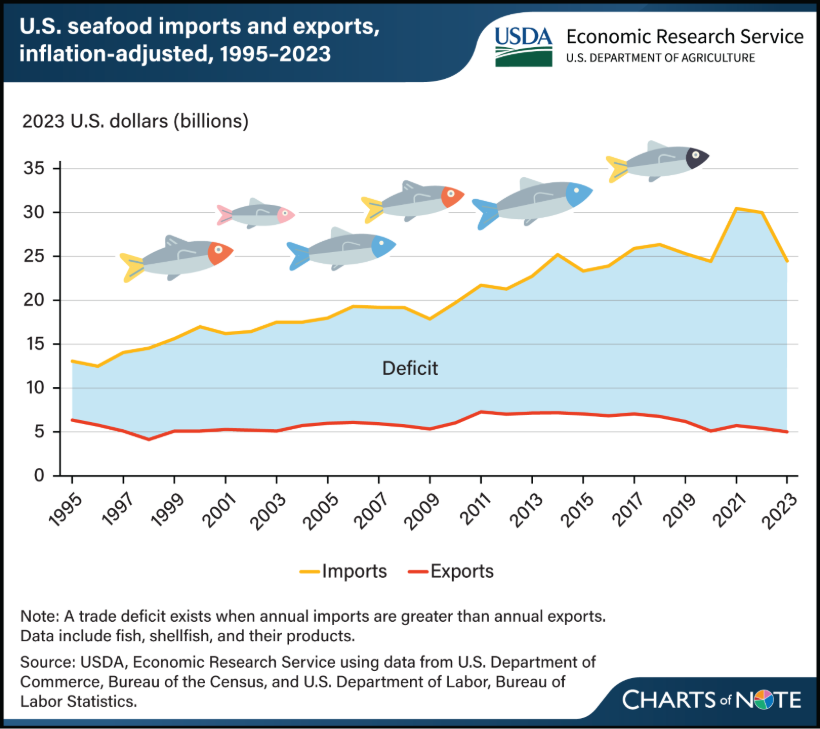

- Resilient domestic food industry: Another set of reasons I heard for investment in the cultured protein industry was the importance of developing and maintaining a domestic food industry. First, the U.S. imports about 80% of the seafood we consume annually (see chart above). Second, American beef cattle herd sizes are tied to drought conditions, with the Farm Bureau reporting that 2024’s cattle herd size was the smallest in 73 years, which is one of the drivers of high beef prices in the U.S. And third, China is increasingly investing in the new cultured meat technologies, so developing a home-grown industry could be important.

The Current Market and Investment Potential for Cultivated Meat

One thing that struck me immediately while listening to founders discussing their challenges navigating the “Valley of Death” common to all technology developments transitioning from research to commercialization was how similar the discussion sounded to the ones I participated in as a renewable energy investor in the hype years of the 2000s and 2010s. During that time, many investors were:

- Looking for “silver bullets” that would be able to solve all energy challenges and meet myriad, diverse energy needs;

- Laser-focused on specific metrics, like solar cell energy conversion efficiency ratios.;

- and holding onto the belief, still present today, that new, renewable energy sources need to be able to compete with existing fossil-based energy without subsidies, totally ignoring the vast subsidies for fossil fuels.

I heard analogues to all of those arguments at the event. While one startup present discussed ground beef as their target market, others focused on high-end restaurants as their target customers. Several discussed the hyperfocus of investors on specific metrics they could understand, like specific ingredient costs, but that might not indicate the true cost-reduction pathways to be achieved by manufacturing at scale. And one comment I heard struck me particularly: that cultured meat will not be successful until it is as cheap as the cheapest low-quality meat. And in a further parallel to renewable energy, a study in 2023 looked at the amount of governmental spending on animal-sourced food products versus alternatives, such as plant-based proteins or cultured meat, and found in the U.S., the amount was 800 times in favor of animal-sourced food products!

This seems to me to be establishing a bar sky high for a nascent industry, both setting it up for and expecting failure. While many of the solar companies of the early 2000s no longer exist, their technological advances paved the way for the solar industry of today. And while not all new energy generation capacity is renewable, solar and wind are generally agreed to be the cheapest types of new energy to build, regardless of current federal policy.

I recognize that cultured meat may not be for everyone and will not be the silver bullet that reduces the social and environmental impacts of the industrial food system, solves global hunger, and reduces food-linked GHGs. But we at Clean Yield are committed to researching this industry, as well as other emerging trends and innovations, that may help to solve our sustainability challenges. We will continue to actively participate in events and utilize our membership connections to stay abreast of the latest news and advances, and further help us align our clients’ investments with their values.

Get in touch to learn more about how Clean Yield’s investment approach can help you achieve your long-term financial goals in alignment with your values.

Liz Levy is responsible for researching publicly traded equities and managing client portfolios, having joined Clean Yield in June 2024. She brings more than 20 years of experience in Sustainable Investing. She is a Chartered Financial Analyst and is passionate about aligning investment portfolios with values, with deep experience in managing divested, fossil fuel-free, and clean energy investments.

More News & Insights

Upcoming Speaker Series: The Role of Private Capital in Building Affordable Housing for Resilient Communities

We invite you to join us on March 31 at 3 p.m. ET to participate in this critical conversation on affordable housing.

Proxy Voting: A Critical Tool for Individuals and Investors to Influence Corporate Behavior

Learn how proxy voting gives equity (stock) investors a powerful tool to pressure corporations to act more responsibly.

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.