Sustainable Asset Management Aligned With Your Values

It is our top priority to align your portfolio with your values while meeting your financial objectives.

Your Clean Yield portfolio manager will develop an investment policy and portfolio that is tailored to your specific financial goals while applying the financial, social, and environmental criteria we integrate into our investment process. In addition, we’ll help you engage in impact investing, shareholder advocacy, proxy voting, and more.

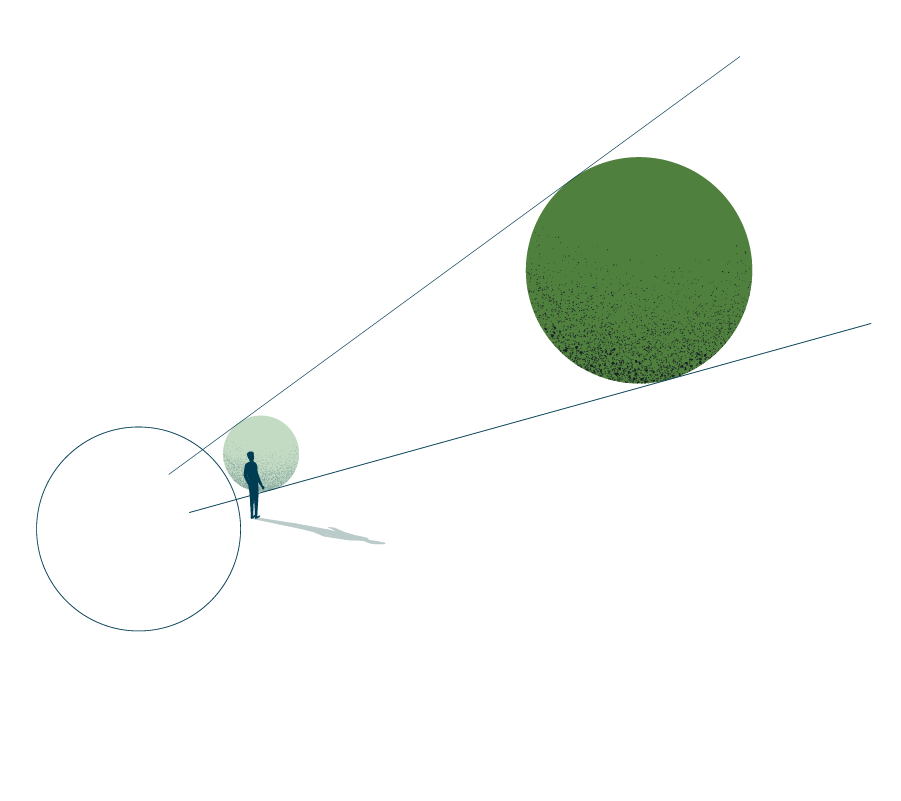

With our personalized approach to sustainable asset management, we empower our clients to be knowledgeable, confident investors who are meeting their long-term goals while making a difference in the world. We uphold the highest standards in social investing and financial acumen and are prepared to serve as diligent stewards of your wealth.

Sustainable Investing

Clean Yield fully activates our clients’ portfolios in the pursuit of helping create the world we all wish to see. Sustainable investing is at the core of our mission. We believe that your investments should not only provide financial returns but also contribute positively to society and the environment. Our approach integrates socially responsible investing (SRI), impact investing, proxy voting, and shareholder advocacy to ensure that your portfolio aligns with your values and drives meaningful change.

Together, these strategies ensure that our clients' investments are not only financially rewarding but also aligned with their values and contribute to a more sustainable world. Clean Yield is dedicated to guiding our clients through every step of the sustainable investing journey, providing expert advice and innovative solutions to meet their unique needs.

Socially Responsible Investing (SRI):

SRI is the foundation of our investment strategy. By integrating environmental and social factors into our investment process, we identify and select companies that adhere to high ethical standards. Our SRI strategy includes both negative screening, to avoid investments in industries or companies that conflict with our clients' values, and positive screening, to actively seek out companies making a positive impact.

Impact Investing:

Impact investing goes beyond SRI by focusing on catalytic investments that generate significant social and environmental benefits. At Clean Yield, we offer opportunities to invest in funds and companies that address critical issues such as renewable energy, affordable housing, and community development. These investments aim to deliver both financial returns and tangible positive outcomes.

Proxy Voting:

As part of our commitment to responsible investing, we exercise proxy voting rights to encourage corporate behavior in line with our values. By voting on shareholder resolutions and board elections, we advocate for practices that enhance long-term shareholder value and promote sustainable business practices. Our clients can be assured that their votes are used to support issues such as climate change mitigation, human rights, and corporate transparency.

Shareholder Advocacy:

We actively engage with companies to encourage better environmental, social, and governance practices. Through shareholder advocacy, Clean Yield leverages its position to initiate dialogues with corporate management, file shareholder resolutions, and participate in coalitions focused on social and environmental issues. This proactive approach helps drive corporate accountability and fosters positive change from within.

Understanding Our Sustainable Asset Management Services

Socially responsible investing (SRI) integrates environmental and social issues the investment process. It involves screening investments to exclude companies or industries that do not align with ethical standards (such as tobacco, fossil fuels, or firearms) and including those that demonstrate positive environmental and social practices. SRI aims to balance financial return with social good, ensuring investments reflect the investor's values.

Our Process

Review highlights of our investment management style and approach and reach out to learn more about working with us.

How will my portfolio be managed?

We tailor your portfolio to your specific financial objectives and risk tolerance, factoring in your tax situation, income and liquidity needs, your current stock and bond holdings, and retirement or estate plans. At your request, we can work directly with other professionals, such as your financial planner or accountant. Each client works with a dedicated Clean Yield advisor who is attuned to your needs and goals and available to schedule conversations.

How will progress be reported?

On a quarterly basis, you will receive a portfolio report including:

- a letter providing our current outlook on the investment markets and commentary on economic conditions,

- a report showing portfolio performance, the market value and cost of your securities, sector allocations, transaction information, and more.

- You will also receive statements from your broker or custodian with your securities’ market value monthly or quarterly, and you will be notified each time there is a purchase or sale.