Values-Based Investing

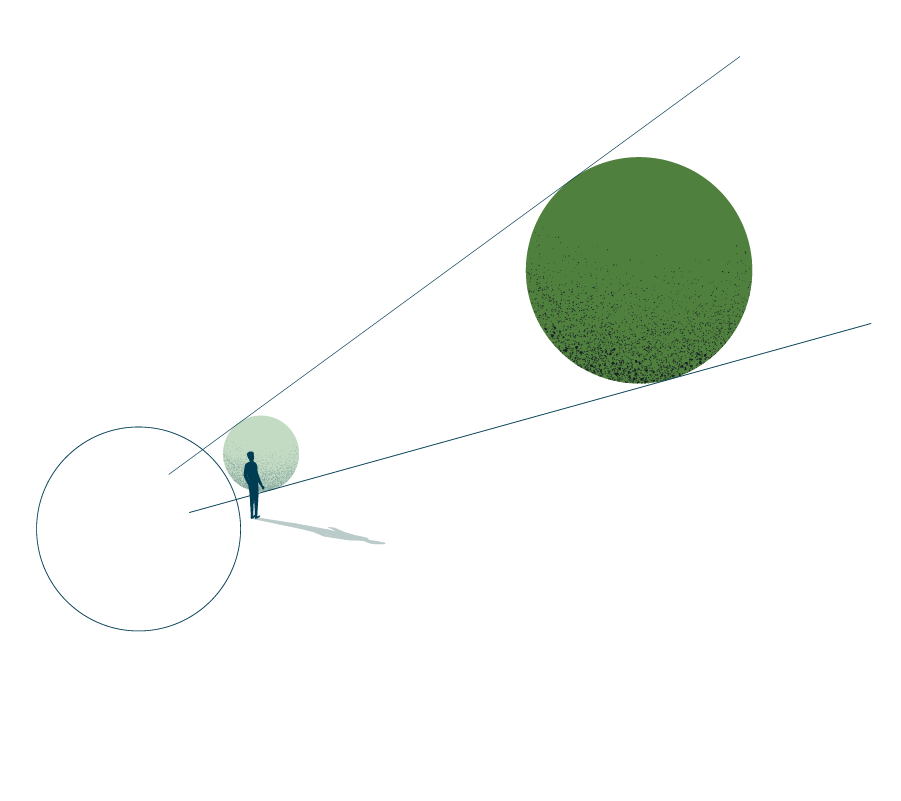

With Clean Yield, you can meet your long-term financial goals while making a difference in the world.

Sustainable Investment Approach

Clean Yield has developed a reliable and effective long-term investment strategy that favors diversified portfolios of high-quality stocks and bonds, supplemented with impact investments. We integrate a company’s environmental, social, and governance profile into our analysis of its financial prospects and stock valuation. We are always looking for ways to maximize the positive impact our clients’ assets can make in the world, whether through proxy voting, shareholder advocacy, or impact investing.

Explore Our Sustainable Investment Approach

We work to develop a deep understanding of our clients’ needs and goals and build customized portfolios integrating the following strategies:

Our investments in public equities are designed to give clients diversified stock market exposure, in line with Clean Yield’s sustainable investment criteria. Our approach is to focus on identifying attractive stocks while considering broader economic factors and context. We seek to build stock portfolios that meet clients’ long-term needs by investing in high-quality companies across the market capitalization and economic sector spectrums. We particularly like companies that are well-managed, with robust profit margins and an emphasis on sustainability-focused products and services. We believe that companies adhering to high standards of environmental, social, and corporate governance have a competitive advantage and will be industry and stock market leaders.

In addition to these financial attributes, companies must meet Clean Yield’s rigorous environmental and social criteria to be added to our client portfolios.