What Is Impact Investing?

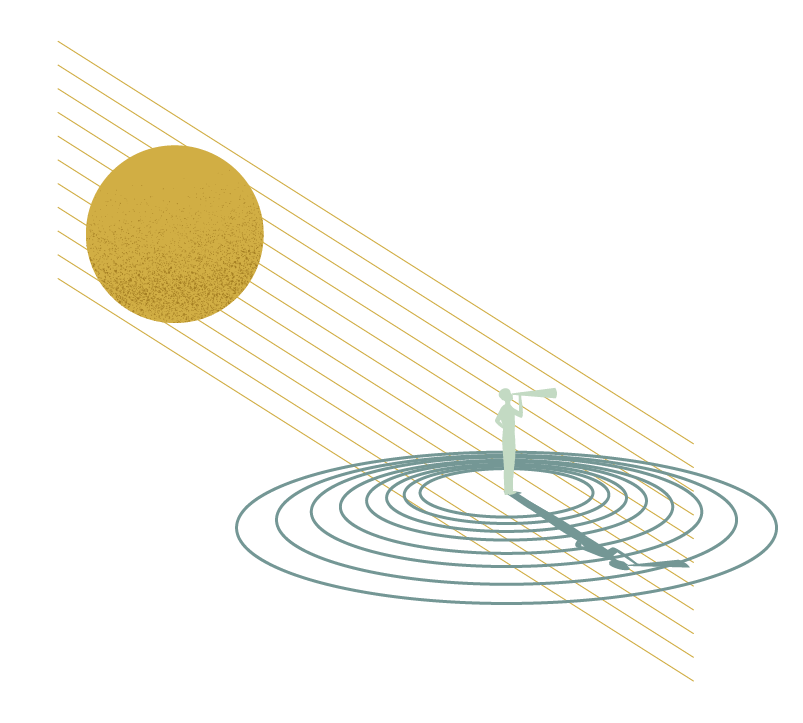

Impact investing goes beyond “clean” portfolios of socially and environmentally screened stocks and bonds, directing capital to mission-driven funds and enterprises that are driving catalytic change in the world.

At Clean Yield, we view impact investing as one of the most powerful ways for our clients to invest their money for positive change. These investments make patient, flexible, and affordable capital available to mission-driven enterprises, providing the lifeblood for them to thrive and amplify their impact. Without mission-aligned investors, these same enterprises would rely on higher-cost traditional sources of financing, or perhaps not even get access to capital needed to grow their businesses. High-impact investing is non-extractive and allows investors to play a role in building more just and sustainable communities.

Clean Yield divides impact investments into two categories: community investments and alternative investments.

What Is Clean Yield’s Impact Investing Strategy?

We began doing impact investing more than 15 years ago, making investments in small agriculture-related businesses in Vermont’s Northeast Kingdom. We embraced Slow Money principles to support investments in regenerative agriculture and local communities when few other advisors were doing so. In 2013 we created a staff position dedicated to high-impact investments.

Our impact investing program continues to focus on regenerative agriculture and community economic development but has expanded to include clean energy, social justice, racial equity, green chemistry, and sustainable forestry — and the areas where these issues overlap.

Clean Yield makes impact investments for its clients on a non-discretionary basis, meaning every investment is approved by clients in advance. We work closely with clients to understand what types of impact investments interest them and identify which opportunities align with their financial goals and personal risk tolerance.

Many impact investment vehicles offer expected financial rates of return that are below “market rate” investments. As non-extractive investments, however, they provide additional social and environmental “returns.” Other vehicles, such as venture capital funds, aim to achieve market-like returns while also making a positive impact on social and environmental outcomes, overlooked enterprises, or underserved communities. Investors need to understand the expected return and risk characteristics of an offering before making an impact investment.

Reach out to discuss with a portfolio manager whether impact investing is right for you.

What Are Community Investments?

Community investments are financial commitments made through promissory notes issued by community loan funds. These funds utilize the invested capital to offer loans and other financial services to low-income or underserved communities, thereby fostering economic development and social welfare.

At Clean Yield, our community investment offerings present clients an opportunity to support local communities while achieving their financial goals. This category of impact investing focuses on promissory notes issued by community loan funds, which provide essential capital to underserved communities.

Four reasons to choose community investments:

- Lower Risk: Community investments are designed to be relatively stable, providing a safer investment option compared to more volatile alternative investments.

- Outsized Community Impact: While the financial returns may be modest, they are balanced by the outsized social impact and lower risk associated with these investments.

- Flexibility and Liquidity: These investments tend to be more flexible and liquid than alternative investments.

- Accessibility: Community investments are generally open to all investors, regardless of account size, allowing more individuals to participate.

The impact and benefits of community investing:

Investing in community loan funds through Clean Yield’s community investments program not only aligns your portfolio with your values but also contributes to the sustainable development of underserved communities. These investments help create jobs, support small businesses, and enhance the quality of life for residents in these areas. By choosing community investments, you are making a tangible difference in the lives of others while securing a stable financial future for yourself. For more information on how you can get involved with Clean Yield's community investments, please contact us. Together, we can build stronger, more resilient communities.

Two examples of community investments in the Clean Yield portfolio:

- Vermont Community Loan Fund: The Vermont Community Loan Fund (VCLF) provides loans and other financial services to support the development of affordable housing, community facilities, and small businesses in Vermont. By investing in VCLF, clients contribute to the economic vitality and social fabric of Vermont's communities.

- Oweesta: Oweesta Corporation works to provide financial resources and capacity-building services to Native American communities across the United States. Investments in Oweesta support initiatives that promote economic self-sufficiency and prosperity within Indigenous populations.

What Are Alternative Investments?

Alternative investments comprise a variety of financial instruments, including private investment funds and direct private placements, structured as debt, convertible debt, or equity. Unlike community investments, alternative investments are typically higher risk and less liquid, making them suitable for investors with a higher risk tolerance and a long-term investment horizon. Clean Yield offers a diverse range of impact investment opportunities through our alternative investments.

Clean Yield seeks to find alternative investments that are focused on catalytic change, often at the intersection of environmental sustainability and social justice.

Three reasons to choose alternative investments:

- Focused Impact: Alternative investments can offer a chance to invest in an enterprise or fund that is focused on making a significant social or environmental impact in a specific market or region.

- Higher Potential Returns: Alternative investments often offer higher expected returns compared to community investments, reflecting the higher risk associated with these opportunities.

- Diverse Investment Forms: From debt and convertible debt to equity, alternative investments provide a range of financial structures to suit different investment strategies and objectives.

The impact and benefits of alternative investing:

Investing in alternative investments through Clean Yield offers the opportunity to support innovative projects and companies that are driving positive change. These investments are ideal for those who are looking to diversify their portfolio with higher-risk, higher-reward opportunities that align with their values. By engaging in alternative investments, you can be part of cutting-edge developments in sectors such as sustainable agriculture, renewable energy, and other impactful industries. Clean Yield is dedicated to helping our clients navigate these opportunities, providing expert guidance and support to ensure that your investments not only meet your financial goals but also contribute to a sustainable future.

Two examples of alternative investments in the Clean Yield portfolio:

- Iroquois Valley Farmland REIT: Iroquois Valley Farmland REIT invests in organic farmland across the United States. By focusing on sustainable agriculture, this REIT not only aims to provide financial returns but also supports regenerative farming practices that contribute to long-term soil health and reduced carbon emissions.

- Sunwealth: Sunwealth is a pioneering solar investment firm that funds diverse solar projects in underserved communities, from commercial rooftops to community solar installations. Investments in Sunwealth help expand access to renewable energy, reduce reliance on fossil fuels, and promote energy equity.

Impact Investing in the Clean Yield Portfolio

Over 40 years, Clean Yield has built a long legacy of impact investing. The following examples illustrate our commitment to clients and investments that move us toward a more just and sustainable society.

Examples of Impact Investing

Renewable Energy Impact Investing: Navigating Clean Energy in the Age of Policy Uncertainty

Get answers to questions about changes to clean energy policy and how it affects renewable energy impact investing, including in Clean Yield portfolios.

Impact Profile: Oweesta Corporation

Oweesta Corporation is a Native community development financial institution (CDFI) that plays an essential role in catalyzing the flow of…

Clean Yield Celebrates Cooperative Month

October is Cooperative Month! In honor of Cooperative Month, we want to share a bit about what co-ops are and…