The Latest

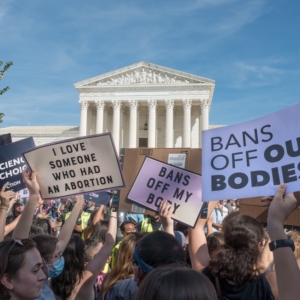

Clean Yield’s Reflections and Actions Regarding Reproductive Rights

No country can ever truly flourish if it stifles the potential of its women and deprives itself of the contributions of half of its citizens. –Michelle Obama

We’ve been reeling this week. The news that the Supreme Court of the…

Concealment Clauses Proposal Earns 64.7% Support from IBM Shareholders

64.7% of IBM shareholders supported a proposal submitted by Clean Yield Asset Management calling on the Company to report on its use of concealment clauses at IBM’s 2022 Annual Meeting of Stockholders. The support for this proposal comes at a…

Statement in Support of Concealment Clauses Proposal at the 2022 IBM Annual Meeting

On April 26, 2022 Clean Yield Asset Management delivered the following statement at the 2022 IBM Annual Meeting in support of its proposal requesting that IBM report on the potential risks related to its use of concealment clauses in the…

Q1 2022 Market Update: A Fragile Market Meets War and Inflation

War in Ukraine’s Impact on Investment Markets

Does the upending of the post-World War II geopolitical order alter our investment strategy? Yes, but not how you might think. We’re still extraordinarily negative toward global stock markets but much more enthusiastic…

Profile: Telia Company

Telia Company, headquartered in Sweden, is the market-leading digital communications provider to the Nordic and Baltic countries. Like other major telecom companies, in recent years it has expanded from providing voice telephone service to wireless voice and data, and fixed-line,…

Stock Market “Corrections” and “Bear Markets”

The stock market (as measured by the S&P 500 index) is down sharply since the start of the year. We thought we would use this moment to clarify some of the terminology and nuances of market downturns.

Amid a long…

Profile: SJW Corp

SJW Corp. (SJW) is water utility that is based in San Jose, California. Like other publicly owned utilities, the company has been diversifying to reduce its climate, economic, and regulatory risks.…

Q4 2021 Market Update: Herd Immunity?

We can sum up 2021 quite simply: Covid, Covid, Covid … and the S&P 500 stock market index hit a record high (more than 70 times). But let’s look “under the hood” and assess prospects for 2022.

This year might…

Company Profile: Vital Farms

In the current massively overvalued stock market environment, it has been far more difficult than usual to find stocks that meet our investment and social criteria. We recently, however, found a new consumer staples stock that seems to offer an…

Night School December 2021: Inflation

Inflation is in the news every day. We see it first-hand at the gas station, the grocery store, and elsewhere. It clearly has captured the attention of both the public and investors. The number of Google searches for “stagflation” (a…

SunCommon Merger is a Bright Spot

In September, we received the news that SunCommon, a private solar company (and Certified B Corp) that we first invested in back in 2013, would be acquired by iSun, a publicly traded, Vermont-based company. While SunCommon focuses on residential and…

Increasing the flow of capital to BIPOC-led funds, businesses, and communities

Clean Yield is committed to using its tools, voice, and power to address racial equity and justice. We do this through our shareholder advocacy, our security selection, and as an employer. We also see opportunities as an allocator of capital.…