Shareholder Advocacy: 2024-25 Year in Review

The world of shareholder engagement and advocacy has its own cadence and calendar, which work backwards from the Annual General Meeting (AGM) season’s peak in May and June. In the summer, as we get ready to strategize about next year, we reflect on the prior year’s work — and what a year this one was.

This 2024-25 Year in Review reflects how the process worked this past year. In the future, there may be new rules and changes impacting our shareholder engagement and advocacy work.

Read our 2024-25 Proxy Voting Year in Review.

How Engagement Works

The engagement and advocacy work we do encompass a variety of tools and methods to use our clients’ capital to make a positive impact on the world. Over the summer, we work with our partners to identify the issues that we want to focus on for the year, the companies we want to dialogue with, and clients that may be able to participate based on their holdings and availability. Then, we approach the companies to learn more about their approaches to managing the issues under discussion. If the dialogue at a company does not progress, we may choose to file a shareholder resolution, which means placing an item for vote at the Annual General Meeting (AGM) on the company’s proxy statement.

Once a resolution is filed, we can continue dialoguing with the company with the intent to negotiate an agreement to withdraw the resolution — if, for example, the company commits to improved policies or practices, or enhanced disclosure. The company can also ask the SEC to let them essentially ignore our proposal during this time, by filing a “no-action” letter. If the proposal is not withdrawn or ignored, it will go to vote at the AGM.

The steps to file a shareholder proposal in the U.S. are tightly controlled by the SEC. As we indicated earlier this year, the Trump administration tweaked some of the rules for this year’s season right out of the gate, even as the resolution process was underway.

The Current Environment

It would be impossible to talk about our engagement activities this year without acknowledging the climate in which they occurred. As many readers of this report probably know all too well, the current administration has declared open season on anything considered “woke,” which most definitely includes sustainable investing and efforts to increase Diversity, Equity, and Inclusion (DEI). Without repeating any of the crude, baseless, or just plain false insults hurled at the acronyms ESG (using Environmental, Social and Governance information to make investment decisions) and DEI over the last few months, suffice it to say that the administration has made doing the work to increase positive social and environmental outcomes much more challenging.

Increasing workplace equality, or DEI in shorthand, remains of vital importance to Clean Yield. We believe, and repeated studies have shown, that more inclusive workplaces lead to better outcomes for investors, as well as employees. And yet, companies are understandably anxious talking about their DEI practices. President Trump ordered each federal agency to identify nine publicly traded corporations, large non-profits, or large foundations, for investigation for failure to comply with the national abolishment of DEI —and we still don’t know what, if anything, is going to happen to companies and organizations on that list. At the same time, right wing activist Robby Starbuck spent the last year systematically targeting consumer facing companies to threaten them with public campaigns to end DEI activities, and a disheartening number of companies caved to his demands.

In addition to cancelling grants to seemingly any institution that has ever published the word “diversity,” the administration is also rewriting rules that govern this work, such as how shareholders can file proxy resolutions. They also introduced much more stringent filing and disclosure requirements for investors seeking to engage with companies through dialogue, seemingly in hopes of discouraging engagement. We are anticipating more changes to come, such as higher ownership thresholds or longer required holding periods. In addition to supporting those two changes, the Business Roundtable, a club for CEOs of the largest companies, published a call for reforming the entire proxy process to effectively prohibit all ESG-related shareholder resolutions.

In anticipation of actions such as these, the Shareholder Rights Group, of which Clean Yield is a member, published a defense and thorough explanation of the importance of the shareholder proposal process in February. And in May, the Shareholder Rights Group and the Interfaith Center on Corporate Responsibility (ICCR, another coalition we are members of) responded to the Business Roundtable, pointing out that its proposed changes could result in board insularity and weakening corporate governance, by denying them the voice of informed and interested investors.

2024-25 Dialogues and Engagement

In recent years, Clean Yield’s shareholder engagement has focused on equity and inclusion, including access to reproductive health care, as we strongly believe these issues are essential to human capital management. During our planning session in summer 2024 — even though we were unsure what the climate would be by the time resolutions were being reviewed and voted on — we maintained focus on those issues. We worked with two partners on engagement: Rhia Ventures, a nonprofit that works to advance policies that protect reproductive and maternal health, and Whistlestop Capital, a consultancy that uses engagement strategies to encourage improved corporate practices.

Lack of access to reproductive health care can threaten both employees’ health and well-being and contribute to lower productivity or lost work time. Additionally, jobs located in states with health care restrictions may not be attractive to top talent, all to the detriment of the employer. We therefore approached three companies on the topic of employee access to reproductive health based in states with strict abortion laws: an electric utility in Idaho, and a personal care products manufacturer and construction equipment manufacturer both based in Texas.

We engaged in constructive dialogue with all three companies and filed proposals at both based in Texas. The proposals specifically asked them to evaluate and report on risks to the companies caused by state policies restricting reproductive rights and strategies to mitigate these risks. While one of the companies requested confidentiality to discuss topics that are contentious in their home state, representatives of all three acknowledged the importance of these issues and agreed to consider our recommendations, and we were able to withdraw both proposals. We also suggested to all these companies that they consider participating in the Reproductive & Maternal Health Compass, a confidential survey and benchmarking of corporate reproductive and maternal health benefits. One company committed to doing so, with the other two considering it. We may continue to have follow-up dialogues with these companies later this year, ahead of the filing season for 2026. Rhia recently published their own Corporate Engagement Impact Report, which has more information on this topic, and we are proud to be an engagement partner.

Companies were already decreasing transparency about DEI efforts this fall as we contemplated our engagement work for the year. We see DEI practices as important indicators of human capital management, and transparency about these practices as important for investors. We initiated an engagement on this topic with electrical components manufacturer Hubbell, based in Connecticut, seeking more information and disclosure about their practices. We filed a resolution, specifically asking for a report on the effectiveness of the company’s DEI practices. We had multiple productive discussions with several representatives from the company, including the General Counsel and the Chief Human Resources Officer, and learned about the company’s practices. While we could not reach an agreement that would include increased disclosure and transparency, given the political environment, we deemed it would not be productive for the resolution to be on the proxy ballot this year. The company did agree, however, to continue this dialogue later in the year.

Accentuating the Positive

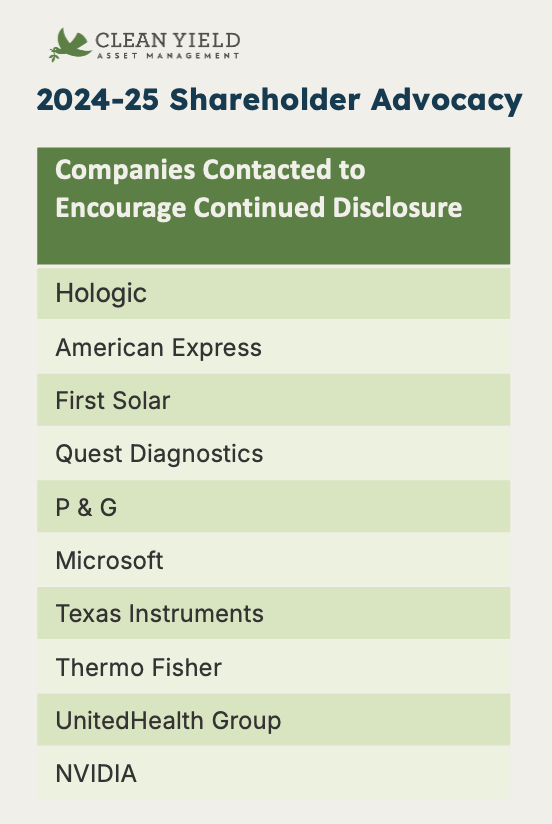

Amid the corporate backtracking on DEI last fall, we also decided it would be a worthwhile endeavor to seek out companies with strong DEI and human capital management disclosure and tell them how much we appreciate and rely on that data.

Working with Whistlestop, we identified ten holdings across our client accounts, including photovoltaic company First Solar, semiconductor manufacturer Nvidia, and healthcare equipment manufacturer Hologic, with notable practices. We contacted representatives of these companies to commend and encourage continuing their disclosure practices.

Summary

We believe that standing together with our community of like-minded investors, learning from one another, and working toward positive social and environmental change is important now more than ever. We greatly value our membership in organizations such as US SIF (formerly known as the Social Investment Forum), the Interfaith Center for Corporate Responsibility (ICCR), Ceres, and the Shareholder Rights Group. And we are committed to communicating to you about this work, through our newsletter and insights.

More News & Insights

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.

Stock Profile: SoFi Technologies

SoFi Technologies, originally named Social Finance, Inc., by its founders, contributes positively to financial inclusion and social well-being by expanding access to affordable financial services through its digital-first platform.

Quarterly Market Outlook: January 2026

As we enter Q1 2026, Clean Yield’s Liz Levy provides a review of what happened in Q4 2025, what we are watching this coming quarter, and how we are positioning our clients for success.