Proxy Voting: 2024-25 Year in Review

Equity (or stock) investors are actually the owners of the companies they invest in. This ownership gives us the right to express our opinion on the management and governance of our companies. Clean Yield’s engagement work is one way we can share our opinions and represent those of our clients with these companies. Proxy voting is another, more formal way. While there may be changes to the types of things we vote on in the future, this 2024-25 Year in Review of Clean Yield’s process reflects our voting for the proxy voting year that ended on June 30, 2025.

Read our 2024-25 Shareholder Advocacy Year in Review.

How Proxy Voting Works

The proxy voting process gives social investors a powerful tool to pressure corporations to act more responsibly. Each year, companies are required to hold Annual General Meetings (AGMs), which most companies do in the spring. At the AGM, equity investors have the ability to vote on a number of resolutions or proposals. In advance of its annual meeting, each company issues shareholders a proxy statement and corresponding ballot, which must be submitted by a stated deadline. The proxy statement summarizes each proposal to be voted on at the meeting, such as the election of board members, approval of executive compensation plans, and environmental, social, and governance proposals put forth by activist investors. These ESG proposals are often the result of shareholder engagement work that Clean Yield, and other like-minded investors, do during the year.

Anti-DEI Resolutions

Given the current political climate, it’s not surprising that the number of “anti-ESG” or “anti-DEI” shareholder proposals increased this year. Perhaps right-wing investors, seeking to undo the work that has improved workplaces and investments over the last several years, believed a large majority of investors would vote with them to roll back DEI policies. However, these anti-DEI proposals have lost by vast margins every time they have been voted on. As a May article on Yahoo Finance noted, “[W]hile anti-DEI proposals have become more common, they are not gaining in popularity… investors asked to vote on anti-DEI resolutions are not biting. Across the board, support for these proposals has ranged from only 1% to 2% of voters.” Impactivize, a journalism non-profit focused on corporate DEI efforts, maintains a tally of anti-DEI votes; as of July 3, of the 30 anti-DEI shareholder resolutions filed at major U.S. companies (and one Canadian one), only one got more than 3% of shareholder votes. And while several months ago company managements were ducking, caving, and cancelling DEI efforts when activist Robby Starbuck so much as looked at them, they are now defending DEI. For example, construction equipment manufacturer Caterpillar faced a proposal asking the company to “abolish” DEI policies, goals, and departments. In its proxy statement rebuttal, the company stated, “We are committed to fostering an inclusive environment and a workforce that is representative of the diverse customers and communities we serve around the globe. Our Values in Action enable every individual to achieve their fullest potential and every team to help drive business success.”

Votes Cast

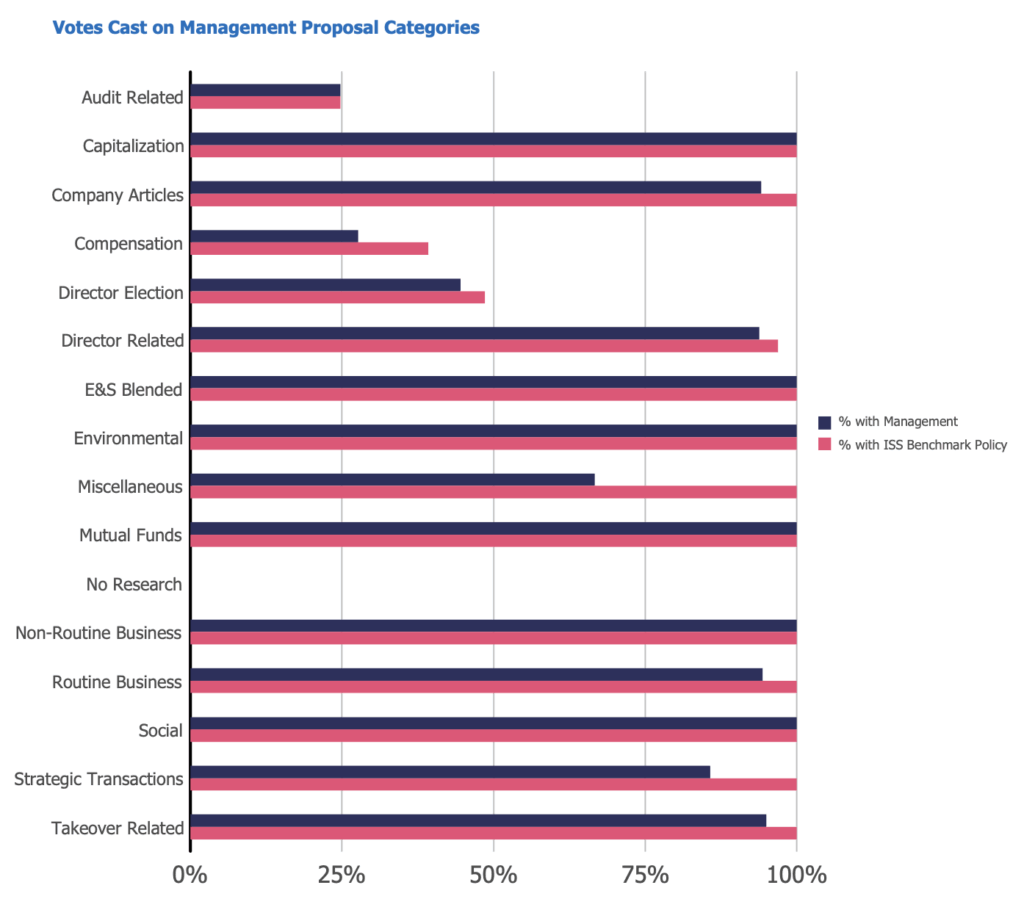

In addition to getting to vote against a few of these proposals, we continued to adhere to our voting guidelines, consistent with our values and similar to prior years. The tables below are generated by ISS, the proxy voting service we used for the voting year July 1, 2024 through June 30, 2025.

The chart at right shows votes we cast on proposals from management. The blue bar shows where we voted with management. The pink bar shows where we voted in line with ISS’s benchmark policy, which are traditional recommendations not designed for sustainability-minded investors. The three categories that jump out of our voting review are:

- Audit related—We vote against ratifying an auditor if they have been the company’s auditor for more than seven years, or if non-audit fees paid to the auditor were greater than the audit fees

- Executive compensation—We vote against executive compensation packages for a variety of reasons, taking into account, for example, the proposed pay package compared to those of peers, total shareholder returns compared to peers, and CEO pay compared to other executives.

- Director election—We vote against entire boards or committees, committee chairs, or specific directors for reasons that may include boards where only some directors are elected each year (called classified boards), problematic audit or compensation practices, or boards that don’t have adequate gender and racial diversity representation.

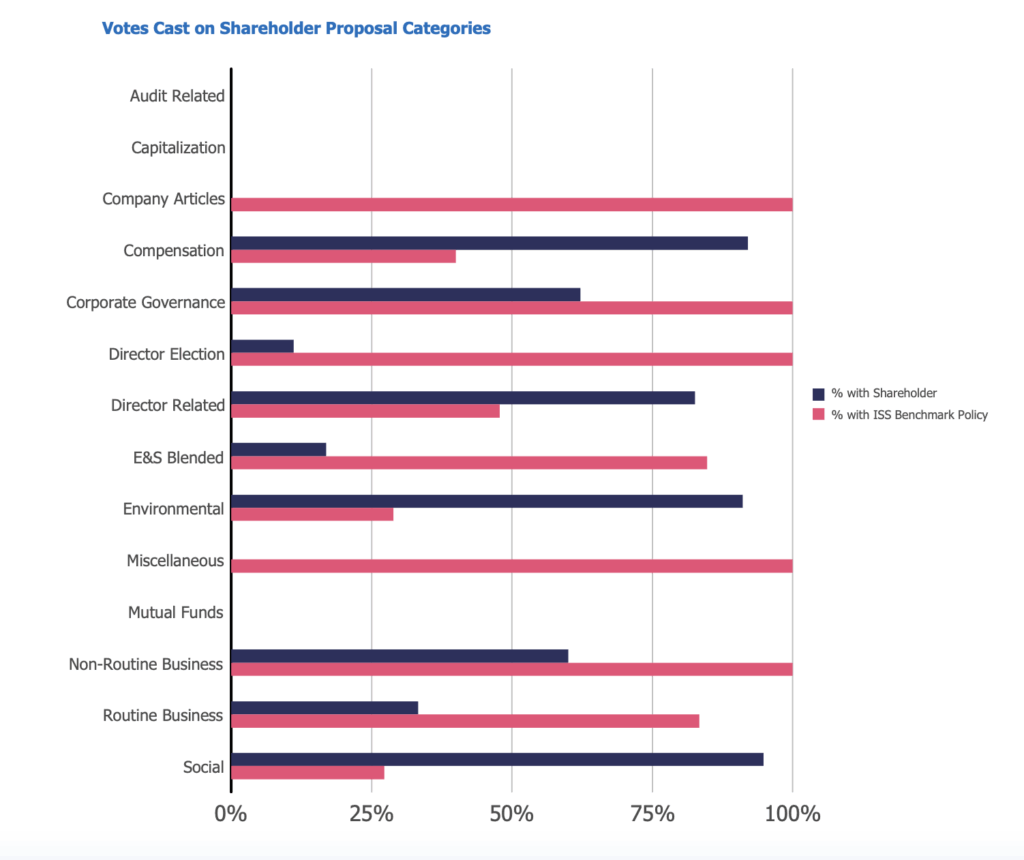

The chart at right shows how we voted on Shareholder Proposals. The blue line shows how often we voted for shareholder-sponsored resolutions, and the pink bar shows how often we voted with ISS’s benchmark policy.

From this chart, we can see that our voting was generally aligned with ISS’s benchmark policy (pink bars bigger than blue bars) on governance issues, and more likely to be aligned with the sponsoring shareholder (blue lines bigger than pink bars) on compensation, environmental, and social resolutions. The “anti-ESG” or “anti-DEI” proposals described above are included int he “E&S Blended” category. Our voting on these proposals aligned with ISS’s benchmark policy in opposing these shareholder-sponsored resolutions.

Summary

Clean Yield is dedicated to ensuring that our clients’ best interests and values are reflected in their proxy voting. We are actively building on our firm’s strong legacy of proxy voting as a driver of social change that moves us toward a more just and sustainable society. And we are committed to communicating to you about this work, through our newsletter and insights.

More News & Insights

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.

Stock Profile: SoFi Technologies

SoFi Technologies, originally named Social Finance, Inc., by its founders, contributes positively to financial inclusion and social well-being by expanding access to affordable financial services through its digital-first platform.

Quarterly Market Outlook: January 2026

As we enter Q1 2026, Clean Yield’s Liz Levy provides a review of what happened in Q4 2025, what we are watching this coming quarter, and how we are positioning our clients for success.