Q1 2019 Market Update: Myths Versus Reality

We live in a bizarre time when our president, his favorite news source, and his followers all see only their own reality, one that rejects evidence. Let’s face it, we believe what we want to believe. This also applies to financial markets. The excesses of capitalism have led to extreme greed and overconfidence periodically throughout history. Investor complacency and greed result in overvaluing stocks relative to their intrinsic value. Then the cycle turns with a large, sustained decline (a “bear market”), resulting in a different type of gross mispricing – of stocks selling well below their intrinsic value. This is associated with exceptional investor fear and pessimism.

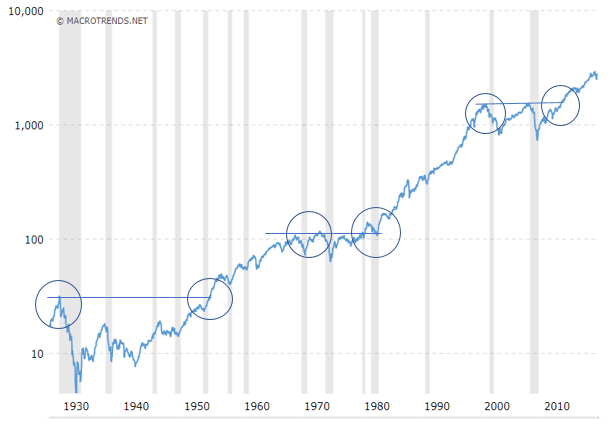

Investors have short memories when it comes to market and economic cycles. As we’ve noted for some time, the current U.S. economic expansion and stock bull market are the longest on record. The financial crisis and Great Recession of 2008-2009 seem like ancient history. Despite the stock market having tripled over the past decade, investors have been complacent in overlooking the historically extreme overvaluation of the stock market. By various measures, stock market valuations are among the three most expensive in the past century.

The common ignorance of market history has spawned several myths about the economy, Federal Reserve monetary policy, and stock market returns. Here are four examples:

Myth #1: “The economy is strong, unemployment is low, and confidence is high, so it must be a good time to invest in the stock market, right?” Wrong.

That is the worst time to invest in stocks. When conditions look strong, the obviously strong conditions are already reflected in stock prices. As the late market observer Joseph Granville said, “When something is obvious to everyone, everyone is obviously wrong.”

Expectations in investing, as in life, are crucial. When conditions are rosy for the economy and the stock market (or especially for an individual company), it is hard to meet those lofty expectations, and the inevitable disappointment leads to lower stock prices (and vice versa). The best time to invest is when things look bleakest (as in 2009 amid the depths of the 2008 financial crisis and Great Recession). As Warren Buffett has said, “Be fearful when others are greedy and greedy when others are fearful.” A former colleague described this as the “pain trade,” when it is painful – and seemingly stupid – to make the trade based on current market sentiment. But such a trade is far more likely to turn out well than to invest based on the conventional wisdom at the time.

Let’s look at two examples of this principle, unemployment and economic growth. The unemployment rate was recently the lowest since 1968. That sounds wonderful, doesn’t it? But 1968 was a major peak in the stock market. High rates of economic growth also tend to coincide with peaks in stock prices. Gross Domestic Product (GDP) growth in 2000 was 5% (much higher than the historical average), which turned out to be the top in the stock market after the technology stock mania of the 1990s, perhaps the greatest peak in stock market history. Similarly, consumer confidence has a high correlation to stock prices. When people feel confident about economic and financial conditions, they bid up stock prices above their intrinsic value (and vice versa).

Myth #2: “Don’t fight the Fed.” (When the Federal Reserve cuts interest rates, buy stocks.) It depends.

Central bank policy is an important factor in determining stock prices. It is commonly thought that central banks are master puppeteers who expertly manipulate policy to ensure prosperity for the economy and for investors. Not really. From the peak in the Japanese stock market bubble in 1989 (stock prices are still down 40% from the 1989 peak), to the peak of the Internet mania in 2000, to the real estate bubble in 2007, central bankers have failed to prevent – and have likely exacerbated – economic recessions and bear markets.

During the last two economic and market cycles, short-term interest rates have risen along with economic expansion and bull stock markets. Interest rates have fallen along with economic contractions and sharply falling stock markets. This counterintuitive evidence shows that central banks raise rates when conditions in the economy and financial markets are strong, even excessive. When economic activity and the stock market turn down, sharply falling corporate earnings overwhelm any positive aspects of lower interest rates.

Myth #3: “Stock prices may be on the higher end historically, but the market simply needs a ‘correction,’ or modest decline, before it heads higher.” Doubtful!

“Correction” is a euphemism. All major market declines begin as “healthy corrections,” but then prices decline… and decline more… and decline more. Then, when prices have declined substantially (by an arbitrary 20%), observers declare that it has become a “bear market.”

Valuations in the stock market today are not “on the higher end”; they’re almost off the charts. Here are two examples:

STOCK MARKET CAP TO GDP

The value of the U.S. stock market relative to the size of the economy (GDP) is one of the three highest over the past century (today, 2000, and 1929).

From today’s extremely high valuation levels, returns over the next eight years will likely be far below average, as they were after the valuation peaks in 2000 and 2007.

SHILLER PRICE/EARNINGS RATIO

Yale professor Robert Shiller (a Nobel Prize winner) uses average actual earnings over the past decade. The Shiller P/E is now the third most expensive ever, going back to the 1880s:

The other two peak periods (1929 and 2000) were followed by spectacular market crashes.

“Stock prices will probably decline after a strong run, but they’ll come back. They always have. I just ride it out because I’m a long-term investor.” Yes, they always have come back – eventually – in the long run. But as British economist John Maynard Keynes said, “In the long run, we’re all dead.”

Investors often fail to grasp how long it can take for stock prices to recover after reaching historic peaks. From the valuation peak in 1929, it took 30 years for the S&P 500 Index to break even; in 1968, 24 years; and in 2000, 13 years.

In addition, unlike in 2000-2002 and 2007-2009, baby boomers are not in their prime working years and are not able to wait years to recover from market losses. Capital preservation is crucial now.

STRATEGY

As we’ve noted for some time, the mispricing of the stock market with historically extreme overvaluation has substantially worsened prospective returns overall. In response, as we traditionally have done, we’ve trimmed stock holdings, especially in the hottest, most popular sector, technology, where risks seem highest. We’ve built up cash reserves to relatively high levels in anticipation of better future buying opportunities and shifted portfolios (within capital gains tax constraints) toward more stable sectors, such as consumer staples, telecommunications, and REITs (real estate investment trusts).

After the sharp decline in stock prices in the fourth quarter last year, the market was poised for a short-term rebound as investor sentiment had become exceptionally pessimistic. The Fed provided the spark for such a rebound, as it stunned investors by announcing a policy change from raising short-term interest rates to holding them steady (bond market pricing now reflects expectations of Fed rate cuts over the next year!).

Investors seem to be overlooking the fact that the reason the Fed is not raising rates is because global economic conditions have weakened considerably in recent months (in contrast to the consensus forecast as well as that of the Federal Reserve). Once again, it often pays to go against the conventional market wisdom – as long as you have the necessary patience.

As for the bond market, bond yields have fallen sharply since last November, with yields on the 10-year U.S. Treasury note falling from 3.25% to 2.40%, as the likelihood of an economic recession has risen sharply. We expect both bond yields and the yield on money market funds to fall as economic conditions and corporate profits turn out to be much weaker than consensus expectations.

The stock market and the bond market are giving opposite signals. The recent surge in the stock market seems to reflect expectations for sustained growth in the economy and in corporate profits. The bond market reflects expectations for sharply lower economic growth, even a recession. One of the markets is dead wrong. We’re siding with the bond market and are positioning portfolios accordingly.

With extremes in global debt levels, U.S. budget deficits, and stock market valuations, we think that even greater measures to protect capital might be appropriate for some of our clients, especially those with lower risk tolerance. After much consideration of various alternative strategies, we’ve concluded that the use of protective put options can provide a measure of portfolio insurance against large declines in stock prices. We will begin to discuss and implement this strategy for interested clients in the coming months.

More News & Insights

Upcoming Speaker Series: The Role of Private Capital in Building Affordable Housing for Resilient Communities

We invite you to join us on March 31 at 3 p.m. ET to participate in this critical conversation on affordable housing.

Proxy Voting: A Critical Tool for Individuals and Investors to Influence Corporate Behavior

Learn how proxy voting gives equity (stock) investors a powerful tool to pressure corporations to act more responsibly.

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.