2017 Proxy Season Wrap-up

The 2017 proxy season brought new highs and lows for shareholder advocates. The volume of shareholder voices reached new decibels this year, with record votes in support of climate risk disclosure at major energy companies Exxon Mobil, Occidental Petroleum, and PPL Corp. These majority votes sent two messages: 1) that a broad base of shareholders want to see energy companies take meaningful action on climate change and 2) that some of the largest asset managers are newly expressing their opinions via proxy votes. While these developments may be surprising (why, in 2017, are shareholders just now getting really concerned about climate change?), it suggests a sea change on climate change and proxy voting. At the same time, this proxy season was marked by renewed threats to eliminate the right of shareholders to file proposals. We have written about these attempts to stymie shareholder rights and what we are doing about them in recent months, and we’ll continue to work with our friends and colleagues to protect this important shareholder right.

Amidst these major shifts in the landscape, which amounted to big drama for shareholder activists, the Clean Yield team saw some exciting progress on important issues.

Over the past year, we focused our engagement efforts in a few key areas that may sound familiar to long-term clients: sharpening CEO attention on environmental and social issues by seeking to link executive compensation to sustainability performance, getting companies to up their game on climate change, and illuminating dark money in politics. We also lent our support to a few gender pay equity proposals, because it makes our skin crawl to think that women still aren’t paid as much as men for comparable work. While the table at the bottom provides an overview of the season, we wanted to highlight a topic of particular focus for us and some of our biggest successes that are lost in spreadsheet form.

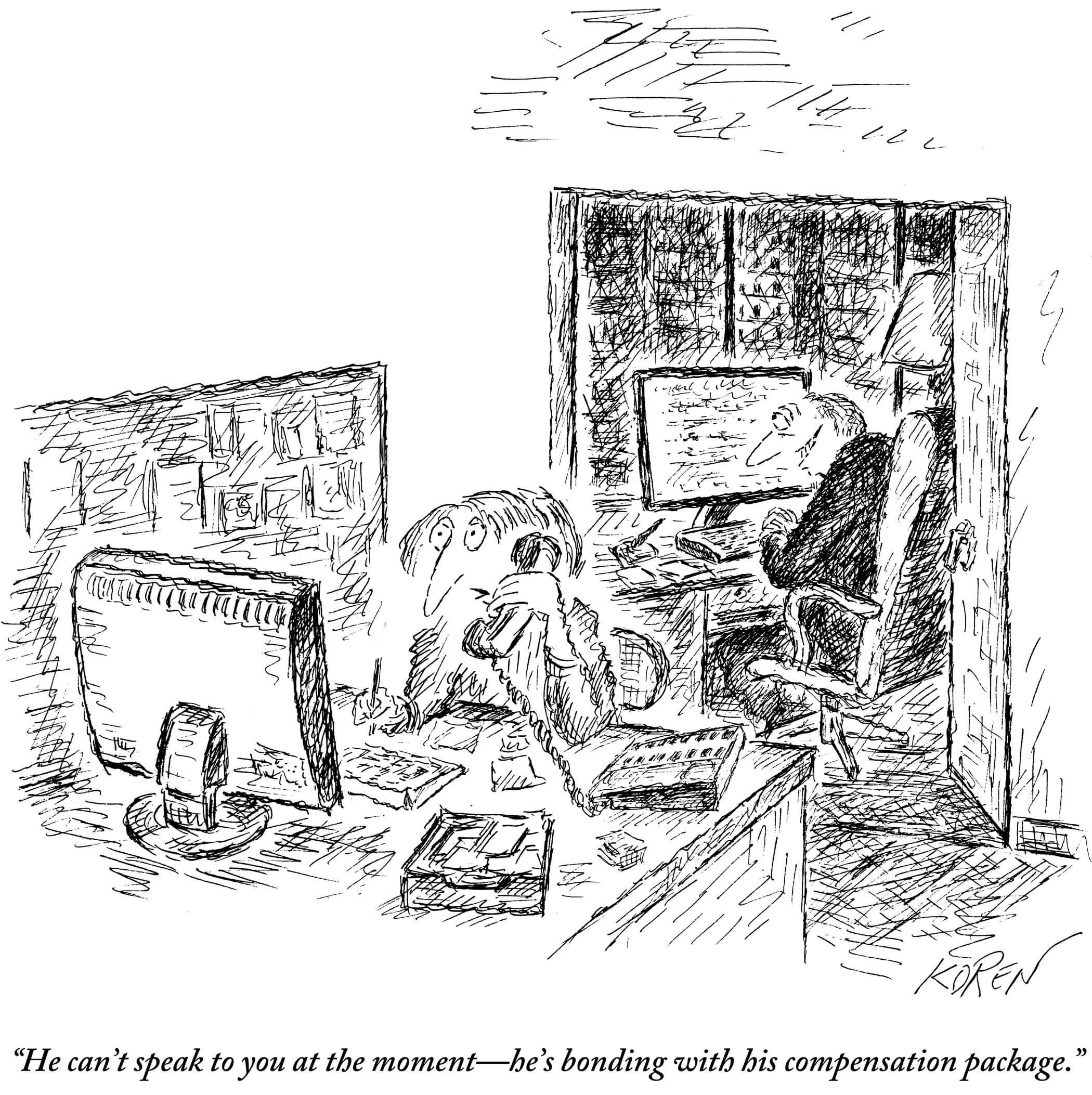

Linking CEO compensation and sustainability performance

Perhaps the best way to determine what a company is really focused on is to look at the incentives of top executives. Is executive compensation just linked to short- and long-term financial performance metrics, or are there performance factors that go beyond financial metrics? Assessing what is and is not considered in determining executive compensation can give a pretty good indication as to what a company really values – and where a CEO is spending time and energy. Over the past few years, we have seen a handful of companies begin to link executive compensation with corporate environmental and social performance such as progress toward greenhouse gas emissions targets, reduced workplace accidents, or improved quality metrics. When a CEO’s bonus depends on meeting emissions targets, one can imagine he or she is thinking harder about those targets than the CEO who is primarily focused on quarterly earnings. Clean Yield started filing proposals linking CEO compensation to sustainability metrics in 2015, and they have gained support every year.

In 2017, we filed proposals at five companies, asking them to link executive compensation with sustainability performance. At Walgreens Boots Alliance (WBA), our proposal received strong support from 23% of voting shareholders. While the company has not yet agreed to link the CEO’s compensation to sustainability performance, the company seems interested in engaging on this issue and committed to strengthening its sustainability practices. We will continue to push on this issue, as well as the company’s approach to energy and carbon efficiency and reducing toxic chemicals in products, this coming year. At Discovery Communication (DISCA), an entertainment content provider, our proposal received a very respectable 19% of the vote. We think the relatively high level of support should send a signal to management. We expect to continue to push the issue at this company as well.

The whole enchilada and then some

And then there’s Chipotle (CMG). As any reader who fancies fast-casual burritos may know, Chipotle has struggled with food safety challenges and a number of foodborne illness outbreaks in the past few years. As investors, we have concerns about what these types of problems can do to the company’s reputation and returns. As burrito lovers, we struggle with the decision to play food poisoning roulette each time we pass a Chipotle. With these concerns top of mind, we filed a proposal at Chipotle asking the company to consider linking performance on sustainability issues (including food safety) to executive compensation. At the same time, our friends at Domini Investments and Trillium Asset Management filed proposals seeking a sustainability report and the adoption of principles for minimum wage reform, respectively. The company engaged in dialogue with this group of shareholders and committed to issuing a sustainability report which will address, among many things, how executives are incentivized to deliver on sustainability challenges and commitments. It will also report on its sustainable food sourcing program and efforts to reduce the risk of foodborne illness. While the conversation with Chipotle is far from over, we were pleased with the outcome of this engagement and withdrew the proposal. We look forward to continued dialogue with the company on these issues.

Wells Fargo (WFC)

If tales of salmonella and norovirus weren’t enough to hold your attention, there’s Wells Fargo. As the story goes, Wells Fargo employees are alleged to have opened nearly 2 million fake accounts in customers’ names for the purpose of meeting sales targets. Following the news, shareholders were quick to engage the company around its ethical standards and related systems. We saw an opportunity to bolster these efforts and make sure that top executives at Wells Fargo were really thinking hard about business ethics. Together with the Unitarian Universalist Association, we filed a proposal asking the company to link executive compensation to sustainability performance and business ethics. The company was happy to engage and acknowledged that our proposal raised an important discussion on the topic internally. After a fruitful dialogue, we agreed to withdraw our proposal and are looking forward to tracking the company’s efforts to implement these changes.

Our engagements with Chipotle and Wells Fargo are important and resulted in changes that we think will be good for all investors in these companies, as well as for burrito lovers. However, they represent just two of the engagement efforts led by the Clean Yield team this year and are part of a much larger body of work.

The Final Tally

Overall, in 2017, we led the filing of five resolutions and filed proposals alongside colleagues at seven companies. Three proposals, those filed at Chipotle, Wells Fargo, and UPS, were successfully withdrawn, and a handful of others received healthy shareholder support.

| 2017 Clean Yield Shareholder Proposals | |||

| Company | Our “ask” | Our role | Result |

| American Express | Gender pay equity | Co-filer (led by Arjuna) | 11.60% |

| Mastercard | Gender pay equity | Co-filer (led by Arjuna) | 7.80% |

| Walgreens Boots Alliance | Link executive pay to sustainability performance | Lead | 23.10% |

| Discovery Communications | Link executive pay to sustainability performance | Lead | 19% |

| Chipotle | Link executive pay to sustainability performance | Lead | Withdrawn |

| Expeditors International | Link executive pay to sustainability performance | Co-filer (led by Sonen) | 21.80% |

| Wells Fargo | Link executive pay to sustainability performance | Co-filer (filed with the Unitarian Universalist Association) | Withdrawn |

| Alphabet | Political spending proposal | Lead | 12.72% |

| Berkshire Hathaway | Political spending proposal | Lead | 11.07% |

| UPS | Renewable energy | Co-filer (led by Zevin) | Withdrawn |

| Kraft-Heinz | Sustainable forestry proposal | Co-filer (led by Domini) | 13% |

| Exxon Mobil | Lobbying disclosure | Co-filer (led by United Steelworkers | 27.50% |

It was a busy year of advocacy in Clean Yield land. While we are pleased with the results of our efforts, there is so much more work to be done – both to protect the rights of shareholders to file resolutions and to push companies on important issues as we move into a less-regulated environment. We look forward to updating you on this work as the 2018 proxy season comes into view.

More News & Insights

Upcoming Speaker Series: The Role of Private Capital in Building Affordable Housing for Resilient Communities

We invite you to join us on March 31 at 3 p.m. ET to participate in this critical conversation on affordable housing.

Proxy Voting: A Critical Tool for Individuals and Investors to Influence Corporate Behavior

Learn how proxy voting gives equity (stock) investors a powerful tool to pressure corporations to act more responsibly.

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.