Putting Sustainability Oversight Into the CEO’s Job Description

The average corporate CEO makes over $16 million per year. Although the image of the CEO goes hand in hand with office treadmills and bottomless cups of coffee, I sometimes wonder if they are, paradoxically, the most unmotivated people in the world. You don’t have to pay the average worker $43,835 per day to show up at the office; in fact, the average worker shows up for about $53,200 in annual salary (303 times less than the average CEO, according to the Economic Policy Institute).

But this is not another article decrying outrageously high executive pay levels, their disconnect to corporate performance, and the failure of all previous attempts to rein in the excess, whether through tax mechanisms penalizing high salaries or good ol’ naming-and-shaming. Let’s put that aside for the moment and instead let our imaginations roam elsewhere to ask: for $40,000 a day (net after meals and subway), isn’t it time that CEOs’ pay was at least partially contingent upon the environmental and social performance of their companies’ operations?

This is not a radical idea; in fact, it’s a practice on the rise. It’s difficult to track precisely how many companies have established this linkage, but Ceres and other monitors of the practice have found an incremental uptick in recent years. According to a 2014 report by Glass Lewis, recent studies put the uptake among large publicly traded companies between 24 and 54%. The authors attribute the wide range to differing survey methodologies and definitions of sustainability.

These companies traverse industry sectors and include heavyweights such as Alcoa, Intel, BASF, Unilever, and Baxter. Alcoa ties 20% of executive compensation to performance on safety, environmental stewardship, greenhouse gas reductions, and energy efficiency. Baxter’s 2014 proxy statement says that its CEO’s performance goals include “constituent relations (including with respect to sustainability matters).” Pepsi’s compensation committee evaluates CEO performance in part on metrics that include “driving sustainable innovation, increasing customer satisfaction, and managing and developing a diverse and talented workforce.”

As companies experiment with these metrics, there is no one-size-fits-all approach, and this makes sense, since companies face different sustainability challenges. But the motivation is the same one underlying the inclusion of financial indicators in compensation packages: what gets measured, gets managed.

This proxy season, Clean Yield is playing a lead role in facilitating shareholder proposals at a group of companies, calling on them to study how they might link executive pay to sustainability performance. Our first proposal of this type for the 2016 proxy season was filed at Walgreens Boots Alliance, a follow-on to a similar proposal we presented to the company last year, and our second was filed at Chipotle. Several more are in the works.

While over 100 years old, Walgreens has been growing like a teenager this decade, acquiring Duane Reade, Drugstore.com, Kerr Drug, and the U.K.’s Boots Alliance. The acquisition of Rite Aid is pending regulator and shareholder approval. The 2014 Boots Alliance acquisition piqued the interest of the Singing Field Foundation, a Clean Yield client. Boots Alliance had cultivated strong environmental and social programs, but Walgreens’ were less robust, and the chain was under siege by environmental health organizations for using controversial chemical ingredients in its branded products. Singing Foundation president Jonathan Scott wrote in The Clean Yield last year,

We believe that a decision by Walgreens to [link executive pay with sustainability performance] will help make its pending merger with Alliance Boots smoother and more profitable, provide some competitive advantage over other companies in the sector, and better protect Walgreens against the risk of reputational damage by defusing its adversarial relationship with NGOs with environmental and health concerns.

Walgreens’ CEO made $16,732,555 in 2014.

Why Chipotle? There’s much to love about this company, including its use of 100% antibiotic- and growth-hormone-free chicken, its employment of humane slaughtering methods for pigs, and its pledge to go GMO free. But it’s not clear to us that Chipotle is up to the challenge of managing all of the risks that bedevil the restaurant industry, from disgruntled and low-paid workers to health risks in the supply chain. In the past 15 months, customers and workers have fallen ill from food-borne viruses linked to outlets in California, Minnesota, and the Pacific Northwest. When auditors found that a supplier was violating its animal welfare standards, the chain had to stop serving carnitas at one-third of its restaurants. Incorporating sustainability measures into executive compensation calculations should come naturally to a company whose slogan is “food with integrity.” It’s not so much to ask of a CEO who made $28,924,270 last year, either.

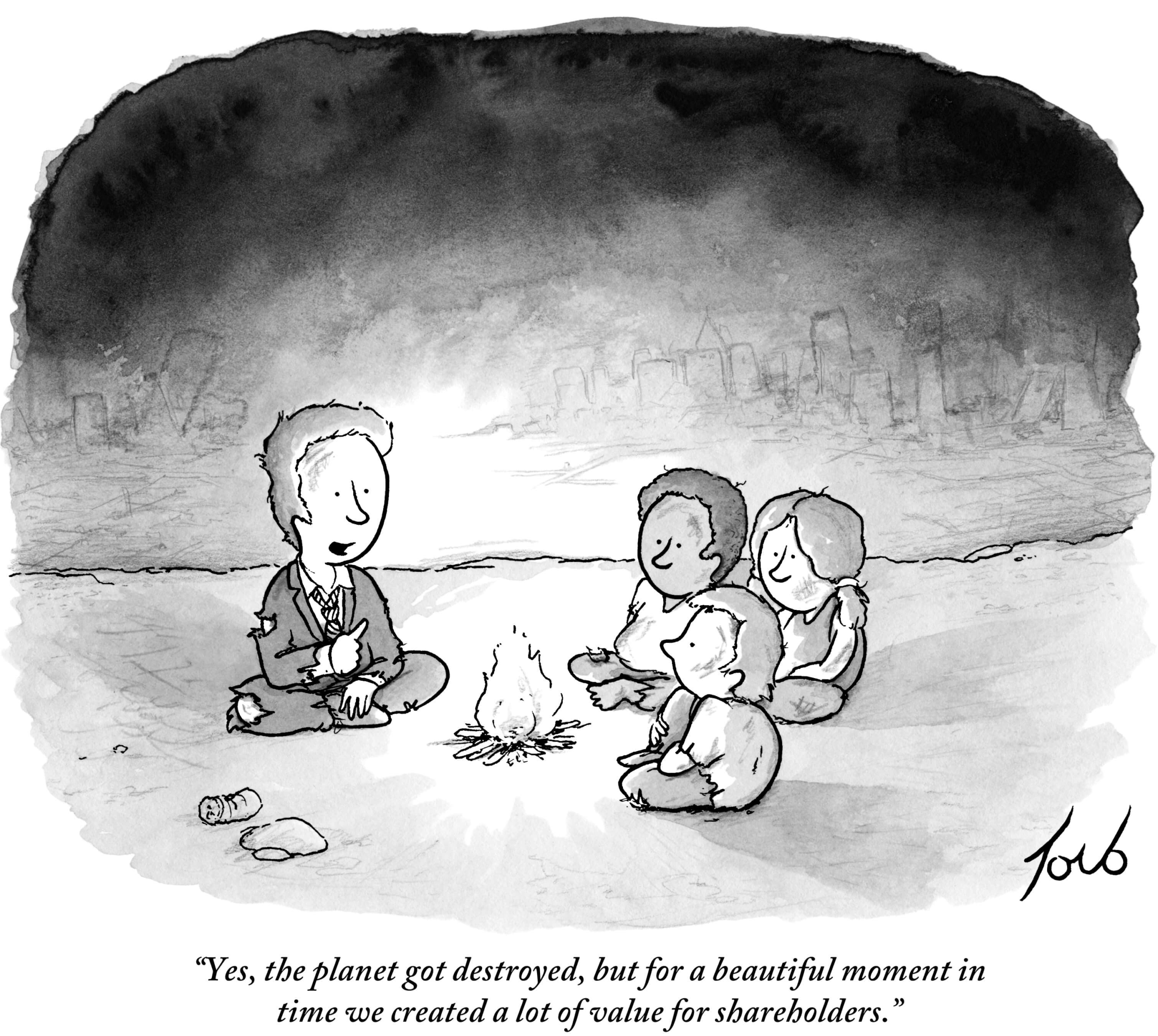

In our view, the modern CEO’s job description needs to reflect the fact that the environmental and social challenges we face today are profoundly impacted by corporate activity (some would say are caused by it) and accept the responsibility that comes with that. The inverse is true as well: environmental and social trends impact and proscribe corporate activity.

But there’s more to top-down sustainability oversight than the gloomy job of managing the risk of bad outcomes – there’s a world of business opportunity in creating goods and services that create a more sustainable future. Companies in every sector can benefit by integrating sustainability opportunities into their business strategies, and the ultimate success of business strategy and vision is the CEO’s bailiwick. In a recent issue of this newsletter, we highlighted how Unilever, driven by the vision and leadership of CEO Paul Polman, integrates sustainability challenges and opportunities into multiple layers of its business strategy. Greenbiz.com reported in May that Polman of Unilever earned a $722,230 bonus for meeting sustainability targets in 2014, including reducing carbon emissions, water use, and waste.

Corporate sustainability performance is too important to delegate exclusively to board committees and perennially understaffed sustainability departments. Sustainability challenges, risks, and opportunities must be integrated into the highest level of corporate strategic decision making, right there in the C suite with the treadmills, bottomless coffee cups, and panoramic views. The largest study of CEOs and sustainability to date, conducted by the United Nations Global Compact and the consulting giant Accenture, indicates widespread agreement with this perspective. Of those surveyed,

- 76 percent believed embedding sustainability into core business will drive revenue growth and new opportunities,

- 93 percent regarded sustainability as key to success,

- 86 percent believed sustainability should be integrated into compensation discussions, and 67 percent report they already do.

It’s a promising starting point, and we look forward to the conversations we’ll have with many companies to come.

Related Articles on Our Website

Walgreens, We Need To Talk

New SEC Rule to Mandate Disclosure of Ratio of CEO Pay to Average Worker Pay

Unilever (UN): Sustainability is the Strategy

More News & Insights

A New Kind of Meat

Through Clean Yield’s U.S. Sustainable Investment Forum membership, Liz Levy attended a meeting to gain insights on the emerging cultivated meat industry.

Stock Profile: SoFi Technologies

SoFi Technologies, originally named Social Finance, Inc., by its founders, contributes positively to financial inclusion and social well-being by expanding access to affordable financial services through its digital-first platform.

Quarterly Market Outlook: January 2026

As we enter Q1 2026, Clean Yield’s Liz Levy provides a review of what happened in Q4 2025, what we are watching this coming quarter, and how we are positioning our clients for success.

![(A man and 3 children sit around a fire in a scorched wasteland) (Newscom TagID: cncartoons024155.jpg) [Photo via Newscom]](https://cleanyield.com/wp-content/uploads/2015/12/cncartoons024155-150x150.jpg)